This is a contributed article from the world’s leading free financial newsletter, WealthResearchGroup.com. If you haven’t already, we highly encourage you to subscribe to their newsletter now!

All of a sudden, it’s fun to be a market bear. For 13 years, between 2009 and 2022, the bulls looked at the alarmists as outsiders. They argued that we’d deal with the national debt in 30 years.

It hasn’t been 30 years, and the problems are now here. The bears are now putting aside any bullish progress and calling it a bear market rally… focusing only on the negative.

The retail public and its sentiment can be gauged by looking at new account openings on the Robinhood app or by looking at trading action in Tesla stock, and I can tell you that they’re nearing real capitulation.

But the most accurate way to really understand how pessimistic the individual investor is can be found in the chart below that shows you that they are as underweight on equities as they were when Ben Bernanke was running the show and trying to save the world’s largest banks from crumbling.

Courtesy: Zerohedge.com

That alone isn’t enough to make me double down or use leverage or a line of credit and just go big and heavy because I don’t think the economy is in such a bad slump that the recovery can be fierce and hugely profitable.

The economy is under attack from central banks that are making life horrible for those that abused zero-percent interest rate policies, but we are not in a severe recession with bankruptcies and dismal earnings.

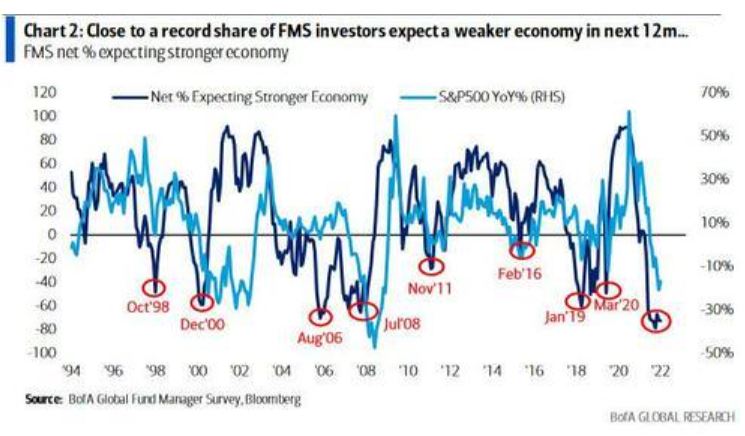

In fact, like many, I think we’ll see the real slowing down in the months ahead, and fund managers are in agreement:

Courtesy: Zerohedge.com

As weird and perverse as it sounds, you want to see charts like this if your goal is to deploy capital because it means expectations are extremely low. Therefore, the sellers have all left the room.

The chart below is even more unique since it shows that if you were in a room of money managers saying brighter days are ahead, you’d stick out like a sore thumb.

Here are a few things to keep in mind before looking at the chart below:

- The market is CHEAPER, but not truly a bargain like at the end of other major crashes

You can almost say that what happened thus far was mean reversion that occurred extremely fast.

- Not all market crashes must resemble 2008!

Don’t be the one out there looking at 2022 and saying that it looks like a battlefield but that you’ve seen worse ones with more casualties so it can’t be the end.

- Keep in mind that many on this fund manager survey joined Wall Street around 2008, so they have only lived through a bull market.

Courtesy: Zerohedge.com

The reason that I personally think we have much more to go through is that the world’s governments are not all on the same page whatsoever.

In 2009, all governments were printing currency, propping-up markets, and looking for ways to get back on the horse.

Today, there’s far less unity. Countries are at odds with each other and the FED isn’t looked at as a central bank that’s being a sugar daddy but as a stringent grandfather who doesn’t want to spend anything and wants his grandchildren to learn the tough lessons on their own.

The bottom line is that nothing suggests a boom just because we’re in a bust.

We are not securities dealers or brokers, investment advisers or financial advisers, and you should not rely on the information herein as investment advice. We are a marketing company and are paid advertisers. If you are seeking personal investment advice, please contact a qualified and registered broker, investment adviser or financial adviser. You should not make any investment decisions based on our communications. Examples that we provide of share price increases pertaining to a particular Issuer from one referenced date to another represent an arbitrarily chosen time period and are no indication whatsoever of future stock prices for that Issuer and are of no predictive value. Our stock profiles are intended to highlight certain companies for your further investigation; they are not stock recommendations or constitute an offer or sale of the referenced securities. The securities issued by the companies we profile should be considered high risk; if you do invest despite these warnings, you may lose your entire investment. Please do your own research before investing, including reading the companies’ SEDAR and SEC filings, press releases, and risk disclosures. It is our policy that information contained in this profile was provided by the company, extracted from SEDAR and SEC filings, company websites, and other publicly available sources. We believe the sources and information are accurate and reliable but we cannot guarantee it.

Please read our full disclaimer at WealthResearchGroup.com/