Call me greedy. Call me what you like. I honestly don’t care. It’s not actually as bad as it sounds.

I’m not some super smart investor with a big portfolio. In fact I don’t hold that much, which is why you probably shouldn’t be listening to me. But you’re probably going to hear me out anyway.

Still here? Cool!

This isn’t a Motley Fool article so I’m going to get to the point without any teasing or forcing you to subscribe to The Libertarian Republic’s mailing list, which I’m not even sure we have.

I’m buying shares of PG&E (Stock Symbol: PCG); a California-based electricity and natural gas provider. I have no affiliation with them or otherwise interest in them, and this is not sponsored content. I don’t even live in California, and there’s no way in hell I would.

The cause of the deadly California wildfire known as the Camp Fire has been tied to PG&E’s equipment.

From NBC Bay Area:

“NBC Bay Area has learned that authorities investigating the deadly Camp Fire have tied its origin to the failure of a single steel hook that held up a high voltage line on a nearly 100-year-old PG&E transmission tower.

The fire began at the base of a transposition tower, which serves to redistribute the electricity on the system to balance the load and assure safety. The tower has two arms holding out the “jumper,” a part of the line that’s being shifted to another point at the top of the tower.”

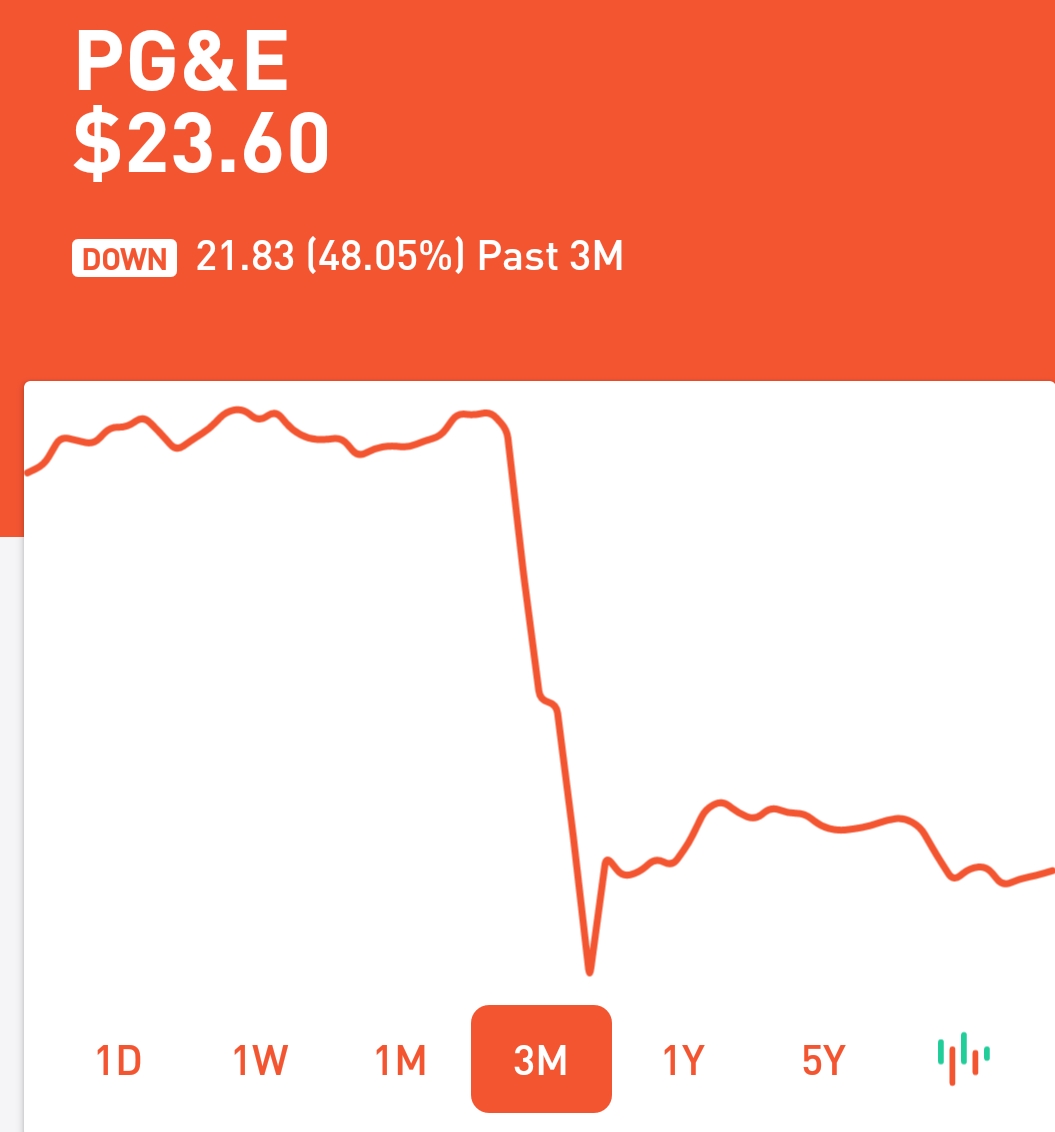

PG&E’s stock value has been punished on Wall Street. At the time of this article, the stock price is at $23.60 per share, down from. $45.43 per share. This is up from its low of $17.90 per share at the bottom of the plummet.

This current stock price is based on speculation, which is a short-term force. Eventually, reality sets in with a market correction that reflects the actual value.

In other words, this price reflects panicked traders jumping ship. Right now might be a good time to start picking up those pieces.

Sure, PG&E will probably have some hefty lawsuits on their hands which will cut into their profits. This is what the price driven down by speculation is currently designed to reflect. PG&E hasn’t actually lost money at this point, however.

PG&E is preparing for the coming lawsuits by asking state regulators to approve rate hikes. A rate hike amounting to $8.5 billion has already been approved for 2019, but PG&E is asking now for a larger 3 year rate hike plan.

In other words, Californians who don’t have a choice of utility providers will be shouldering a major part of this burden. Insurance will be shouldering some as well.

And of course, shareholders of PG&E will be expected to shoulder some. But will shareholders be asked to shoulder half the company’s overall value as their portion, which the stock price currently reflects?

My money is on no.

If that is the case, this would then make the price per share artificially low at its current price, or known as undervalued.

If you don’t have a trading account, I recommend Robin Hood. It’s a free app and there are no trading fees. Just remember that stocks are a long game and trading fees discourage impulsive buying and selling. So don’t be impulsive.

You can download Robin Hood to your mobile device or tablet through this link (which will direct you to the app’s location in your app store), where you’ll be rewarded with a free share of a random stock just for signing up.

As the above link is my referral link, I will get one too, and that’s my only angle. You’re certainly more than welcome to not use this link and go to your app store on your own, but you won’t get a bonus share. And more power to you if you would prefer to use something else and pay trading fees, I guess.

Neither the author nor The Libertarian Republic assume any risk or responsibility for your finances. Like I said, you probably shouldn’t listen to me.

29 comments

slots online

online casino

viagra price

viagra without doctor prescription

online casino slots no download

san manuel casino online

slots online

slot machine games

buy cialis online reddit

generic cialis tadalafil best buys

short term loans

loans for bad credit

loan online

loans for bad credit

online loans

installment loans

viagra prescription

viagra pills

cialis generic

cialis 5 mg

cialis 20

new cialis

cialis internet

cialis 5 mg

cialis 5 mg

cialis 5 mg

cialis to buy

cialis to buy

online casino

casino online slots

online casino usa real money

casino online

slot machines

best online casino real money

casino games

casino online

viagra no prescription

viagra online prescription free

purchase viagra

viagra reviews

sildenafil citrate

viagra discount

buying cialis online safely

cialis prescription online

buy real cialis online

generic cialis at walmart

buy cialis pills

cialis generic name

cialis tadalafil

tadalafil liquid

real money online casinos usa

real money online casino

online slots for real money

online casino usa

Buy now viagra

Free viagra

… [Trackback]

[…] Read More Information here on that Topic: thelibertarianrepublic.com/sure-ill-profit-from-the-california-wildfires/ […]