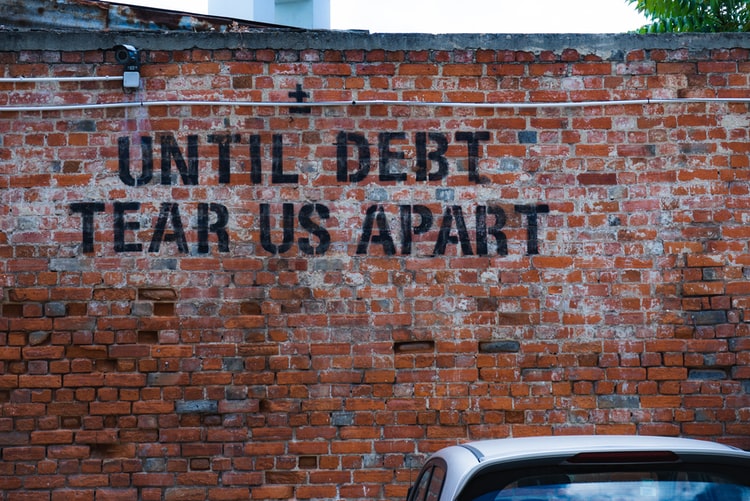

Having debt can be a stressful thing, but having debt with an awful, audacious, and angry debt collector is even more stressful to a whole lot of levels. They can be a pushover when they’re trying to make you pay. With these kinds of attitudes, The law passed a Federal Fair Debt Collection Practices Act to prevent these debt collectors from abusing and antagonizing the borrowers.

As a borrower, you should know the things that they can’t do to you, so you’ll know when to take legal action. You can have the confidence that they are not mistreating you or taking advantage of you. Here are five schemes that debt collectors are prohibited from doing to their borrowers:

They are not allowed to come to your Workplace.

It is against the law for a debt collector to go where you work and urge you to pay for your debt. Under the act, debt collectors can’t publicize or disclose your debt in front of your co-worker. They are only allowed to call you at work, but they still can’t tell your co-employees that they are debt collectors. And if you ask them not to call you at work, they should respect your decision as stated in the law.

They can’t pretend to work for a Government Agency.

Under the FDCPA, the debt collectors can’t approach you and pretend that they are working for any federal or state government office. Many debt collector agencies in the past tried to do fraudulent activities to their borrowers to urge them to pay.

They Can’t Harass You.

Harassing borrowers is extremely against the law, and harassment can come in many forms. Below is the list of the things they are not allowed to do:

- When they call you without permission about your debt, they can’t call you before 8:00 am or past 9:00 pm. They also can’t bombard you with repeated calls. You can file a lawsuit for debt collection harassment if they still call you before or beyond the allowed call hours.

- They are prohibited from threatening you by harming you physically or by resulting in violence. Using profane, rude, or indecent language is also a form of violence, so they also can’t talk to you with any of that.

- They can’t try to contact you if you already put in writing not to do so and only to contact you by your attorney.

- They can publish or post any information about you not paying or having debt with them.

They may still contact you, though, even if you won’t allow them. They can call to tell you that they will no longer contact you, and they may have filed a lawsuit against you. If you feel uneasy about the lawsuit, you can contact the court and confirm if there is really a legal action filed towards you. Remember to search the court’s information on the internet and not rely on the papers that you received because they might also put a false contact number and email on it.

They can’t threaten or even try to arrest you.

Debt collectors are not allowed to arrest or detain you because of the debt you owe them. They also can’t try to accuse you of a crime or threaten to arrest you if you don’t pay the money you owe them. It is because collection agencies are not entitled by the law to issue arrest warrants or to bring you to jail. But, if you receive an order really authorized by the court and you fail to show up, it is then that the judge may release a warrant to arrest you. You can also go to jail if you’re unable to pay for the court fine connected to your debt.

They can’t come to you for debt that you don’t even owe.

The industry of collection agencies tends to have inaccuracies about the information of their borrowers. The documents that they have can be incomplete or incorrect, which can cause debt collectors to go to the wrong person and ask for money they don’t even owe. This can happen when the debt collector that you owed money with sells you debt to another debt collection agency, which in turn can also sell it to another agency. This routine can cause mistakes and make debt collectors have the wrong information.

They can also try to contact a person that already paid their debt. If you’re doubtful about the debt, you can wait within five days after they contact you, if the collector will send you a notice which will have the information about how much you owe and to whom you owe it to. In your part, you can also send a letter requesting more details on the collector for a return receipt. You can go to the Consumer Financial Protection Bureau to provide you with a sample letter to make sure that you won’t include unnecessary information that they can use against you in the future.

Final Thought

It is essential to educate yourself about your legal rights and fight for it. So if you sensed that you’re illegally asked to pay off a debt, you can always find a good lawyer and file for a debt collection harassment to relieve you from the stress. And more importantly, the best thing that you can do to avoid debt collectors is to responsibly pay your debts on time.