When we experience a strange event in life, we tritely dismiss it saying “Truth is stranger than fiction.” It is easy for us to laugh at the delightful movie, Brewster’s Millions, which is based on a 1902 novel, about how hard it is to spend a lot of money quickly. But what about when the federal government spends trillions quickly?

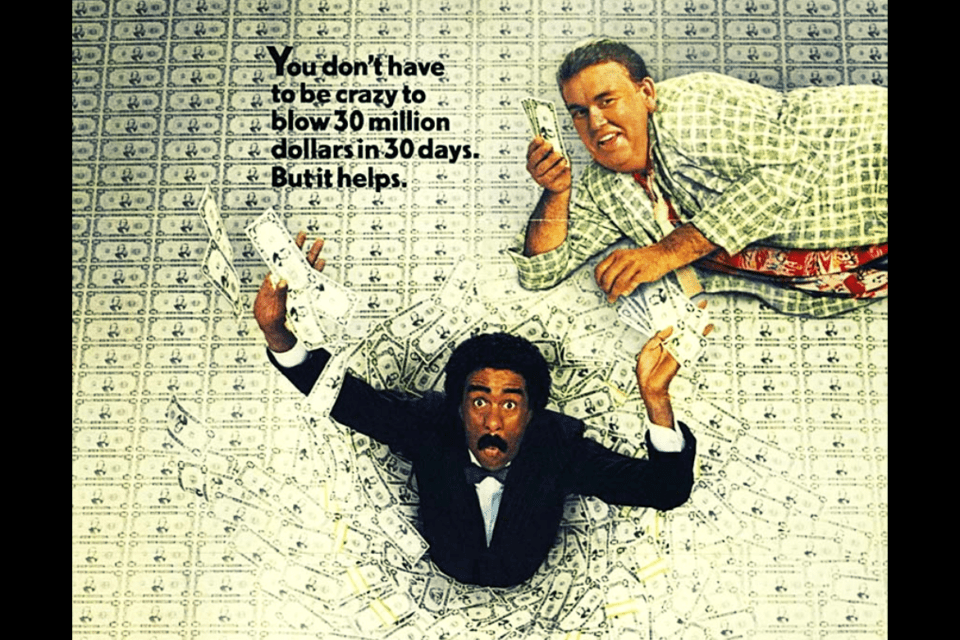

Brewster’s Millions

Brewster is given the opportunity to inherit a fortune if he can spend a large amount of money ($30 million in the 1985 movie version) in thirty days. At the end of that time, Brewster must be penniless. His spending however, is limited in that he can only give so much to charity, or lose so much to gambling. He must get value for services and he cannot destroy property. The most difficult condition is he cannot tell anyone why he is recklessly spending money.

Brewster finds difficulty spending $30 million so quickly. But he spends and at the end, when he believes he is penniless, a friend, worried about his spending, tells Brewster he saved a large amount of the money paid him for services and gives it back to him. Needing to get rid of the money in minutes, Brewster punches a lawyer and immediately settles by offering the remaining money.

Even in fiction, it is hard work to spend a massive amount of money in a short period of time, but it’s funny to watch.

Federal Trillions

This is where “Truth is stranger than fiction.” In a few months in 2020, the federal government produced the reality version of Brewster’s Millions, commonly known as the CARES Act, and a few other laws, to address the coronavirus pandemic. In this real-life version of Brewster’s Millions, the president and Congress believe, to keep their jobs, they must give away trillions of dollars in a short time and each time the Feds give money away, they must find another reason to give away more money.

The “Groundhog Day” nature of the giveaways is needed since the last restraint in limiting federal money supply, the need for green ink for printing dollar bills, was eliminated by using electrons to distribute money directly to people. Since money now magically appears, it necessitates continuous giveaways.

The Feds acted amazingly quick for government. Our elected representatives appear in Congress, wearing masks, making them look like the robbers they are. The President, acting like a “circus freak-show barker,” queries whether people could shoot-up with disinfectant to stave off the virus? In such a frenzy the Feds quickly spend trillions.

Law 1, $8.3 billion to develop vaccines to fight the virus and disaster relief for small businesses.

Law 2, $100 billion for paid sick leave for workers, free virus testing but without available tests, food assistance, supplemental nutrition for women and children.

Law 3, $2.2 trillion including direct giveaways to individuals, grants to small business with good banking and political connections, suspension of interest on student loans, $32 billion just for airline employees, tens of billions for the airline industry, $100 billion for hospitals, and a half a trillion for the Federal Reserve to purchase almost any type of corporate bond.

Law 4, another $484 billion more for additional grants to small business and hospitals.

Even before Law 4 is signed into law, Congress begins developing Law 5, a $500 billion law to send money to states and municipalities, more money for food assistance and more checks to individuals. To move quickly with this new legislation, the Democratic majority in the House of Representatives delegated all drafting power over the new legislation to the Speaker of the House. Acting on decades of “wisdom,” the Speaker increased the proposed new giveaways to $3 trillion and immediately passed it in the House.

As Law 5 is being drafted, a Congresswomen proposes law 6, to give $2,000 a month to every adult in the nation and $1,000 a month to every child.

Laws 7 to infinity, are the Political requests of the many trade associations in DC whose only reason for existing is finding ways to siphon-off taxpayer money to their industries. These same associations have a long tract record for demanding and securing bailouts: Lockheed, 1971; Franklin National Bank, 1974; Chrysler, 1980; Continental Illinois Trust Company, 1984; the S&L crisis, 1989; the Airline industry 2001; Bear Sterns, Fannie Mae/Freddie Mac, AIG, 2008; Citigroup, and the entire financial industry in 2008; Auto industry, 2008; Bank of America, 2009 and today CARES and all its coattails.

There is simply no reason to believe they will not be successful again.

Concurrently, the president, who’s only feeling of importance is when people praise him, demands his name appear on every check, to take credit for all the giveaways. This check signing process is merely a legal mechanism for buying votes with taxpayer money.

On top of all the money Congress and the president are giving away, the Federal Reserve has a magic money machine that allows it to turn $454 billion into a $4 trillion corporate give-away through the purchase of bonds.

The children shall inherit the debt

Brewster spends all $30 million and gets the big inheritance. He also gets the girl and we imagine; he lives happily ever after. As Shakespeare wrote “All’s well that ends well.”

As to the federal trillions, Congress and the president certainly spent more money than anyone ever thought possible, in a few months. Whether these elected officials keep their jobs or needed to spend even more money for voters to be satisfied, is to be determined in November, 2020 by the recipients of the federal giveaways.

What is certain however, is that the children of this nation will inherit the debt. Lots and lots of debt. Seventy-seven percent of the U.S national debt was incurred by three presidents – George W. Bush, Barack Obama and Donald Trump. Simply, in 2001, at the end of the Clinton administration, our national debt was only $5.791 trillion. When all the giveaways are completed, the national debt will be well over $26 trillion. The portion of every citizens’ debt today is about $ $72,000; and likely to exceed $82,000 per person in six months.

Since it is highly unlikely anyone alive today will offer to even start paying off the debt, yes, children, it is to a certainty, you will inherit the debt.

Mark Twain explains why truth does not always end as well as fiction, when he remarks,

“Truth is stranger than fiction,

but that is because fiction is obliged to stick to possibilities;

truth isn’t.”

1 comment

… [Trackback]

[…] Info on that Topic: thelibertarianrepublic.com/brewsters-millions-federal-trillions-kids-inherit-debt/ […]