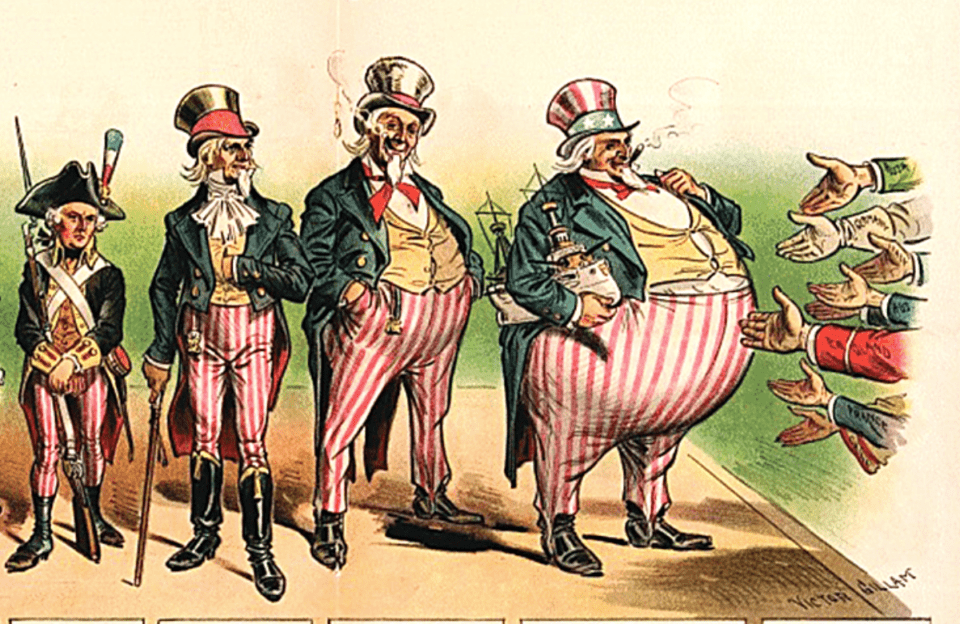

Americans are obsessed with weight loss, but generally, they are getting heavier each year. The same is true for an obese federal budget.

Congress pontificates about reducing its massive national debt of $30 trillion, but each year it gets bigger. Diet books don’t help one lose weight. Only by reducing food intake can weight be lost. The same is true for budgets. Bloviating about the national debt on cable TV will not reduce the debt. Only by cutting programs and reducing laws can Congress reduce the national debt.

In 2021, our federal government spent $6.82 trillion in a $22.4 trillion economy. Simply, 30% of all economic activity in the U.S. is federal spending. Another $3.3 trillion was spent by state and local governments. Forty-five percent of our entire economy is government spending. The Government Accountability Office (“GAO”) informed Congress that the growth of the national debt is unsustainable and a risk to our future. It’s now time to stop spending and start reducing the nation’s debt to ensure a sustainable nation for our children.

A diet that takes trillions off the federal spending scale without disrupting a lifestyle.

The nation’s goal should be to reduce the national debt with as little disruption as possible. Starvation diets don’t work. The nation just needs to cut out the junk food but keep a good helping of vegetables on our plate. This is doable by recognizing we don’t need to eat every time we see food. Likewise, Congress does not need to spend money every time it sees a perceived “problem.”

Once in this mindset, Congress needs to identify what the American people do not need. Five categories of spending literally jump off the plate.

- Do not fund laws that have not been authorized. The easiest set of budget cuts would be to refrain from funding laws that Congress has not authorized. “In FY 2021 appropriations, the Congressional Budget Office identified 1,068 authorizations of appropriations, stemming from 274 laws, tolling $432 billion, that expired before the beginning of the fiscal year 2022.” Since House Rules prohibit appropriations to fund laws not authorized by Congress, just letting those unauthorized laws expire is an easy savings of almost one-half trillion dollars. If Congress is so unwilling to perform oversight on expired laws or the public has so little interest in a law being reauthorized, Congress should follow House rules and not fund the expired laws.

- Review and vote on every expenditure in the Judgment Fund. The Judgment Fund is the mother of all slush funds. It is a permanent, indefinite, and unlimited congressional appropriation continuously available to pay money judgments entered against the United States and settlements of cases in or likely to be in litigation with the United States. It is so secret that Congress no longer even debates what the amounts are for as an indefinite appropriation. The amounts are appropriated, no matter what the amount. The Department of the Treasury just pays the claims upon the receipt of completed forms.This is the fund that President Obama used to deliver $1.7 billion in cash to Iran as a bribe to sign the Iran nuclear deal. Why should our government officials have billions in a secret fund to cover up illegal activity or to held terrorists? Having Congress approve each judgment and settlement as it did before 1956, the U.S. could save taxpayers tens of billions of dollars by rejecting settlements the executive branch makes with its friends that bring suit against the government knowing of a friendly settlement or with terrorists.

- Enact a fair, simple, tax code that focuses on raising money not legislating behavior. Another easy way to reduce the deficit is to get rid of the 8-million-word tax code and replace it with the 1913- four-page Form 1040. Few deductions and low rates, but everyone pays something, including the wealthiest. The benefit of this simple approach is it captures a greater amount of tax owed by closing the “tax gap.” The IRS defines the tax gap as the difference between true taxes owed for a given tax year and the amount that is paid. The gap is caused by the under-reporting of income, non-filing, and tax evasion. While the exact amount is unknown, the IRS estimates it to range from $574 to $700 billion, annually. A complex tax code invites under-reporting and manipulation, whereas failing to pay taxes in a simple system, could easily place one in a position of defending a fraud or tax evasion charge.

- Follow and implement GAO’s Generally Accepted Accounting Principles (“GAAP”). Congress mandates GAO to perform a GAAP analysis of federal spending and assets and provide recommendations to ensure the financial reporting by the agency is transparent and consistent. Every member of Congress should read these reports on how our money is managed and should implement its findings when mismanagement is identified. One specific GAO recommendation is for the federal government to address the government-wide improper payments, estimated to be $175 billion.

- Congress should make a kitchen-table list of what programs are most important to our Republic. The amount of information available to Congress for making smart debt reduction decisions is overwhelming. It is time Congress puts these materials to use. A simple way to approach this task would be for each congressional committee to rank sequentially, each program within its jurisdiction, with the most important programs having the lowest number. The budget committee would still allocate a budget for appropriations and the highest-priority programs will be funded first. The appropriation committees would work down the list until the revenues raised by taxes are expended.At that point, Congress would have to cease spending money on programs for which there is no longer any money, e.g., studies of shrimp on a treadmill, or admit to the taxpayers, it wants to borrow money to fund programs of little value. This kitchen-table process of spending only up to revenues received could save another $1plus-trillion annually, even if Congress expended a few hundred billion on some lower value programs.

These five modest proposals for reducing the national debt do not disturb any of the programs Congress views as a “must fund.” The reductions all come in areas where Congress has little interest, settlement of lawsuits that should not be settled, making sure everyone pays their fair share on income tax, requiring agencies to only pay authorized recipients, and not spending money on stupid programs.

Is anyone in Congress willing to put the national debt on a diet?

1 comment

… [Trackback]

[…] Information to that Topic: thelibertarianrepublic.com/reducing-national-debt-by-trillions-with-a-5-step-diet/ […]