By Kitty Testa

In mid-September 2011, protestors gathered in New York City’s Zuccotti Park to voice their objections to income inequality, the influence of corporations on government policy, and corruption in the financial sector. It was called Occupy Wall Street. The protest occurred the same year that home foreclosures peaked in the US, and student debt was rising dramatically, well on its way to becoming a $1.3 trillion crisis in 2017. Unemployment rates were still high three years after the 2008 financial crisis, a crisis caused by financial institutions’ investments in credit default swaps, instruments that they created and traded which were essentially useless.

Whatever the protest intended to accomplish—awareness, new regulations, a pathway to socialism—it never posed any real threat to Wall Street or the financial sector. The throngs of protestors camping in the Manhattan park for two months proved to be no more than an inconvenience in the end, and the protestors were evicted from the park before Thanksgiving.

The anger directed at Wall Street was real and not without merit. The big banks and financial firms, whose executives had deceived investors and the public by underreporting losses, were bailed out by taxpayers. And despite the carnage of the crisis, few were charged with wrong doing, and fewer still spent time behind bars.

But something else was happening in 2011 that could pose a threat to the Wall Street, central banking and the financial sector as a whole. It wasn’t an uprising. It was a network of computer developers, hackers and cypherpunks working on a new idea: Bitcoin.

About a month ago, Wikileaks founder Julian Assange tweeted, “Bitcoin is the real Occupy Wall Street.”

Bitcoin is the real Occupy Wall Street.

— Defend Assange Campaign (@DefendAssange) December 15, 2017

Bitcoin was created as a response to the 2008 financial crisis. In its Genesis Block resides an encoded message, a headline from the date it was created: “03/Jan/2009 Chancellor on brink of second bailout for banks.”

What is a bank anyway? Why do they exist? What value are they adding to the economy? The simple answer is that a bank is a trusted third party that validates transactions. But banks also serve as an enforcement arm to the world’s governments. Look at your account balance on line. Is that really your money? No. It’s an IOU. The government can freeze your accounts and take your money, and the banks will comply. The government is as likely to put bankers in jail as it is to put policemen in jail.

But how do you get around banks? How do you do business? How do you get paid? We need banks, right?

Not really, not anymore.

All we need is a system of payments that can account for units exchanged and confirm sends and receives and ensure there is no double spending of units. We have had that for nine years. It’s called Bitcoin.

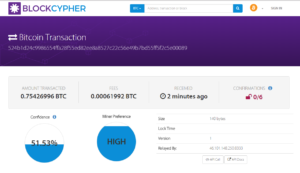

Bitcoin is a borderless, trustless peer-to-peer system of payments that eliminates the role of the trusted third party. A Bitcoin transaction does not need a trusted third party because confirmations are recorded on a distributed ledger which anyone can see. Transactions are released on the network, and every single one of them can be viewed, complete with the transaction’s status. Here is a recent Bitcoin transaction that was just issued to the blockchain. It is still awaiting confirmation.

There are numerous copies of the ledger, and numerous places where you can view Bitcoin’s blockchain, such as here, here, and here. The trusted third party, the bank, has no role in the Bitcoin ecosystem.

It doesn’t occur to most Americans, but about 2 billion of the world’s 7.4 billion people do not have access to banking at all. And even in the US, about 8% of households have no bank accounts. In order to use banking services, you must divulge personal information and often undergo a credit check. No bank is required to let you have an account. Furthermore, access to financial markets where investments can build wealth are severely regulated. Only 54% of Americans are invested in today’s booming stock market, and most of them via a retirement account that they don’t control.

The government and the banks have placed strict controls on entrance into financial markets where banks and investment firms—Wall Street—make their money. A large share of Americans don’t directly benefit from these markets.

But anyone can download and install a Bitcoin wallet, or a wallet for hundreds of other cryptocurrencies. They can buy Bitcoin locally and have it sent directly to their wallet. Anyone can open an account on an exchange like Bittrex or Binance and begin trading in cryptocurrencies (although most exchanges require identity confirmation when withdrawing from exchanges to appease governments).

We are in a nascent period of cryptocurrencies. People are buying them and trading them, but their utility will not be realized until we have more places to spend them. That will not be realized until businesses see a potential in increased market share by accepting them. Still there are many good use cases now. People who want to send money to family members in another country can avoid steep fees by sending a cryptocurrency. People who live in countries with hyperinflation can convert local currency to Bitcoin to protect it from losing its value. Those who are unbanked can use cryptocurrency to trade. And every one of those transactions cuts out the middleman, the bank.

Taken to its ultimate conclusion, Bitcoin has the potential to decimate traditional banking and provide an investment opportunity to people all over the world without barriers to entry other than an Internet connection. There are now cryptocurrencies that are centered around lending and repayment, and the fastest growing means of financing start-up companies is the ICO, initial coin offering. Little by little, the cryptocurrency ecosphere is looking at what financial services firms do and offering solutions.

In the end, what Occupy Wall St. accomplished was popularization of the 99% vs. the 1% paradigm. It was never that simple to begin with. Not much has changed since the occupation of Zuccotti Park. The banksters are exuberant as ever while capital flows into the stock market, which boasts all-time highs regularly of late. The one-percenters are doing just fine.

But so are Bitcoin holders, who represent a tiny fraction of the global population. If everyone who participated in Occupy Wall St. had spent $30 on Bitcoin in the fall of 2011, they would have been able to pay off all their student loans six years later, or maybe driving Lambos, or cashing out into fiat to buy equities. And for all the headlines about price it receives, Bitcoin has yet to enter an adoption phase. What will it take? Another financial crisis, most likely. And don’t worry, there will be one.

2 comments

… [Trackback]

[…] Find More Info here on that Topic: thelibertarianrepublic.com/julian-assange-is-right-bitcoin-is-the-real-occupy-wall-street/ […]

… [Trackback]

[…] Information on that Topic: thelibertarianrepublic.com/julian-assange-is-right-bitcoin-is-the-real-occupy-wall-street/ […]