Michael Bastasch

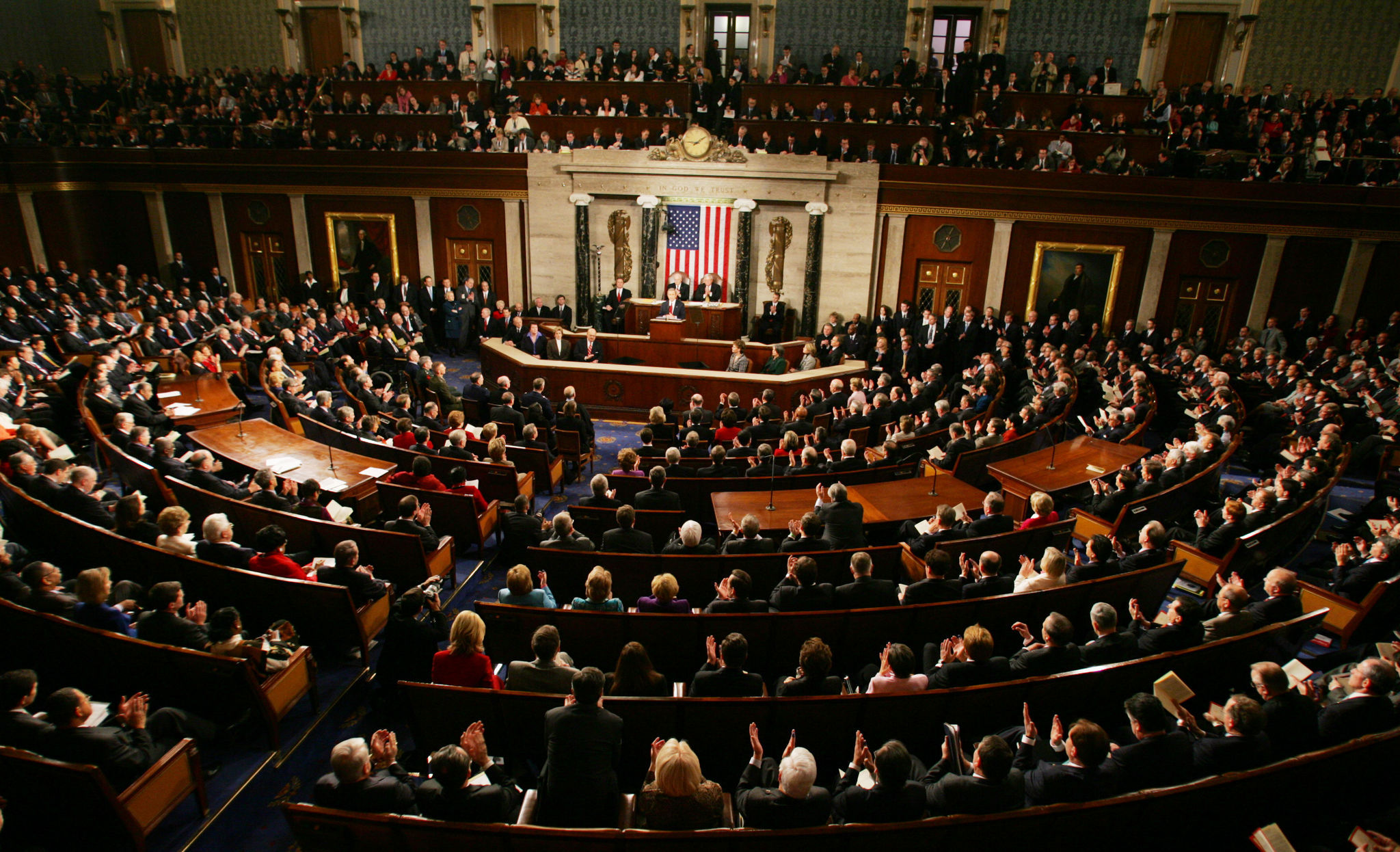

Congress is set to pass a massive bill extending tax breaks for a wide range of activities from energy production to home ownership, but the $1.1 trillion bipartisan tax extenders bill also contains some provisions most people would find a little ridiculous.

The so-called “Protecting Americans from Tax Hikes Act of 2015,” or PATH Act, contains provisions that would tax write-offs for race horses and motorsports arenas. And, of course, there are at least two tax breaks for Hollywood filmmakers, according to a Daily Caller News Foundation review of the tax bill.

TheDCNF has compiled a list of the most ridiculous tax breaks Congress wants to keep in the tax code:

1. Write-offs for race horses?

Congress’ summary of the tax extenders bill would allow race horse owners to recover the costs of their beasts of burden for another three years.

“Section 165. Extension of classification of certain race horses as 3-year property. The provision extends the 3-year recovery period for race horses to property placed in service during 2015 or 2016.”

2. Tax breaks for motorcross?

“Section 166. Extension of 7-year recovery period for motorsports entertainment complexes. The provision extends the 7-year recovery period for motorsport entertainment complexes to property placed in service during 2015 or 2016.”

The Tax Foundation estimated extending tax breaks for motorsports arenas would cost the federal government $33 million in revenues for a one year extension.

3. Hollywood gets its tax breaks too

It wouldn’t be an omnibus without tax breaks for movies and television series. Congress wants to extend at least two provisions pertaining to Hollywood filmmakers. One would allow them to write-off the first $15 million in expenses from filmmaking and another deals with how they classify movie payrolls for tax purposes.

“Section 169. Extension of special expensing rules for certain film and television productions. The provision extends through 2016 the special expensing provision for qualified film, television, and live theater productions. In general, only the first $15 million of costs may be expensed.”

“Section 346. Treatment of certain persons as employers with respect to motion picture projects. The provision allows motion picture payroll services companies to be treated as the employer of their film and television production workers for Federal employment tax purposes. The provision is effective for remuneration paid after 2015.”

The Tax Foundation estimates extending film tax credits would cost the government $6 million in revenue for a one-year extension.

4. Get reimbursed for selling Caribbean rum

Congress also wants to pay Puerto Rico and the U.S. Virgin Islands for excise taxes on rum they sell to Americans. The provision would extend the $13.25 per proof gallon tax “cover-over” through 2016.

“Section 172. Extension of temporary increase in limit on cover over of rum excise taxes to Puerto Rico and the Virgin Islands. The provision extends the $13.25 per proof gallon excise tax cover-over amount paid to the treasuries of Puerto Rico and the U.S. Virgin Islands to rum imported into the United States during 2015 or 2016. Absent the extension, the cover-over amount would be $10.50 per proof gallon.”

The Tax Foundation estimates this will cost the government $168 million in revenues for a one-year extension.

5. Changing the definition of hard cider?

Congress also wants to change the definition of hard cider to be classified as a wine under the tax code. Not really sure what to make of this, but hopefully it won’t make that sweet, appley nectar any worse. That would be a tragedy.

“Section 335. Modification of definition of hard cider. The provision defines hard cider for purposes of alcohol excise taxes as a wine with an alcohol content of between 0.5 percent and 8.5 percent alcohol by volume, with a carbonation level that does not exceed 6.4 grams per liter, which is derived primarily from apples, apple juice concentrate, pears, or pear juice concentrate, in combination with water. The provision is effective for articles removed from the distillery or bonding facility during calendar years beginning after 2015.”

Follow Michael on Facebook and Twitter

1 comment

… [Trackback]

[…] Find More here on that Topic: thelibertarianrepublic.com/congress-gives-horses-and-hollywood-tax-breaks-for-christmas/ […]