The current Coronavirus pandemic is something that has gripped the world’s attention, unlike anything we’ve seen in living memory. While some viral outbreaks such as Ebola are deadlier by swiftly wiping out whole villages, this one is far more contagious and of longer duration.

The current thinking, and what’s being broadcast by political leaders around the world, is to think in terms of months, not weeks, for the duration of COVID-19. Indeed, some reports have suggested over 18 months, which has been discounted in political circles as unlikely. Nevertheless, it’s fair to say that no one really knows, and that’s what is so scary to people.

In this article, we examine whether COVID-19 will damage personal income and whether or not it will create a debt crisis.

How Long will the Jobs Last?

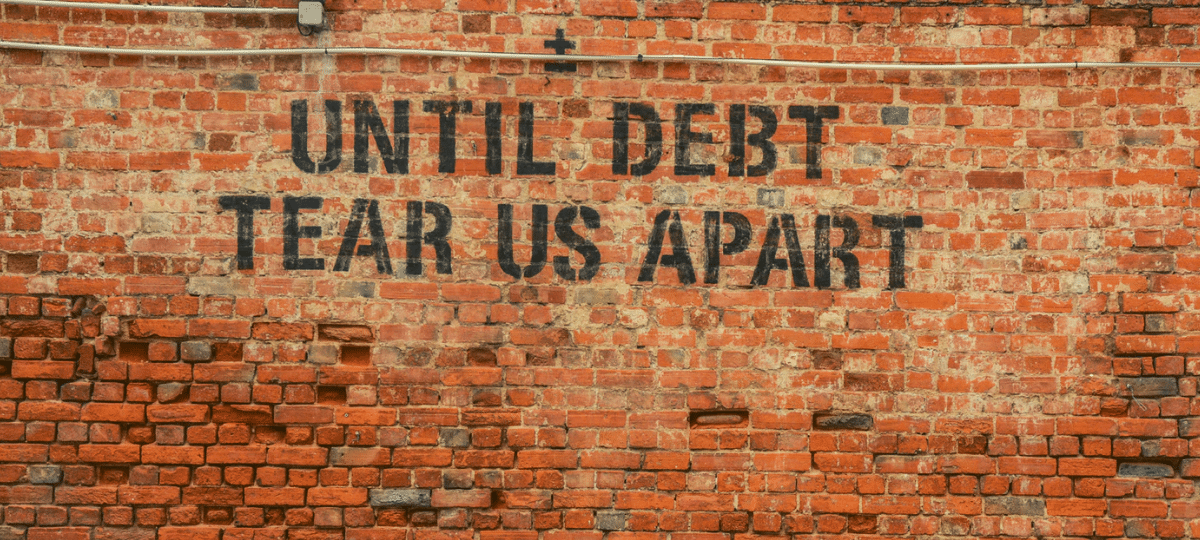

The writing is on the wall for jobs of all kinds. Some industries like travel and tourism are getting decimated. Bars, clubs, movie theatres, and other entertainment centres are feeling the strain as people stay home and avoid crowded places.

The situation globally isn’t much different. UK jobs are at risk, just as those in America are. Indeed, the NY Times has recently said that it’s only just the beginning of the layoffs. The Guardian newspaper also has an article about workers being let go in droves. Some hours are being cut back, a few companies are asking employees to take several weeks of unpaid leave, and others are unsure what to do.

Where Does It Leave Workers?

For the people who still have a job because there’s enough demand for their company’s goods or services and who can work at the office or stay at home, the news isn’t too bad. However, for everyone else, they’ll either see severely reduced hours and commensurately lower pay or no money at all.

At which point, people look to their (usually) meagre savings and any overdraft facility they have at their bank. This money will run out quickly, causing them to need to seek debt finance arrangements to cover the shortfall to pay for essentials like rent, food, utilities and more.

Where Will the Loans Come From?

For people that are still working and have an income, but one which has declined significantly, they have a temporary gap until the Coronavirus settles down and normal hours return. This has to be met by debt, with financial sources likely to get quickly depleted and personal loan processing times extended considerably.

Another option is payday loans. You may have seen them advertised lately. The adverts from lenders like LoanPig may say instant payday loans here! With other loan applications typically taking a few days to process at the least, an advert of this type might not seem believable. Yet, it is.

While we’re heading for a certain debt crisis with too many debt applications being requested by tens of millions of citizens, at least short-term lending is one piece of good news. Financing is available for people who still have some income to cover the payments. That offers a sliver of hope to cover life’s essentials when savings have been depleted already.

2 comments

… [Trackback]

[…] Info to that Topic: thelibertarianrepublic.com/why-covid-19-could-cause-a-debt-crisis/ […]

… [Trackback]

[…] There you can find 84038 more Information on that Topic: thelibertarianrepublic.com/why-covid-19-could-cause-a-debt-crisis/ […]