By R. Brownell

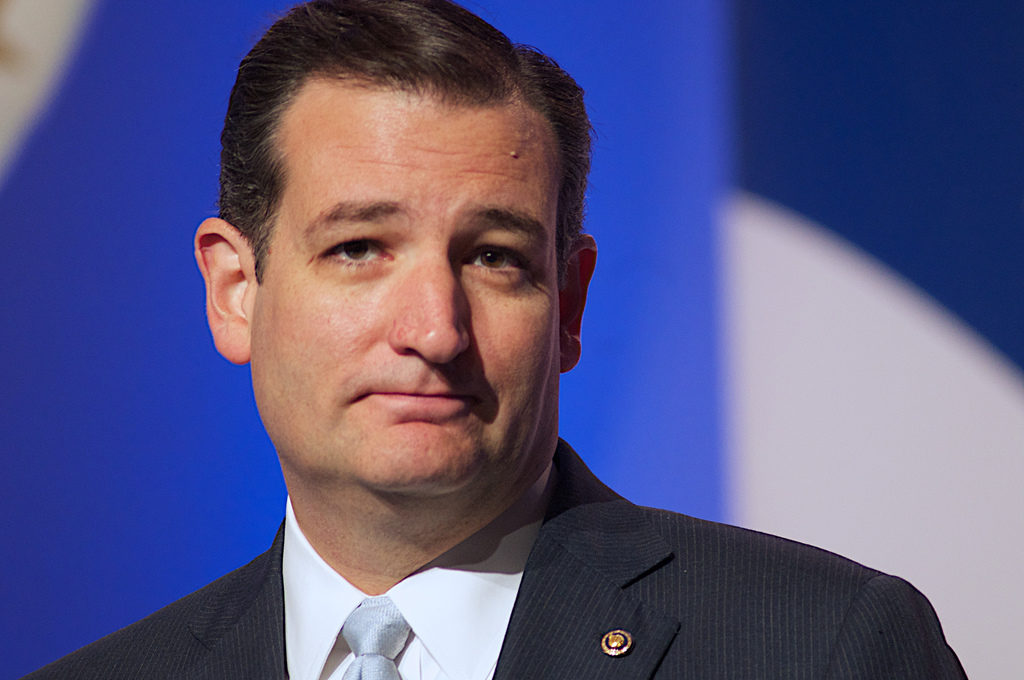

At Wednesday night’s debate, Senator Ted Cruz noted that he has “deep concerns” about the Fed and apart from auditing it, proposed a plan for returning to sound money:

“I think the Fed should get out of the business of trying to juice our economy, and simply be focused on sound money and monetary stability, ideally tied to gold”

On the same day the Fed opted to keep its key interest rate near-zero percent, rather than hiking it for the first time in more than nine years.

//

In a country learning more and more about the dangers of the Federal Reserve’s dangerous monopoly on our currency, the case for the gold standard seems to be one of the only sound options. Robert Murphy from the Ludwig Von Mises Institute hit this point right on the head back in 2008:

As the Fed’s debasement of the currency reaches literally unprecedented levels, more and more regular Americans are waking up to the merits of commodity money. Yet this isn’t some populist fad; there is a whole tradition of excellent academic scholarship touting the virtues of the gold standard.

Ludwig Von Mises himself understood the reason for the hatred of a gold backed currency and defended it adamantly in his book Human Action:

The demonetization of silver and the establishment of gold monometallism was the outcome of deliberate government interference with monetary matters. It is pointless to raise the question concerning what would have happened in the absence of these policies. But it must not be forgotten that it was not the intention of the governments to establish the gold standard. What the governments aimed at was the double standard. They wanted to substitute a rigid, government-decreed exchange ratio between gold and silver for the fluctuating market ratios between the independently coexistent gold and silver coins. The monetary doctrines underlying these endeavors misconstrued the market phenomena in that complete way in which only bureaucrats can misconstrue them. The attempts to create a double standard of both metals, gold and silver, failed lamentably. It was this failure that generated the gold standard. The emergence of the gold standard was the manifestation of a crushing defeat of the governments and their cherished doctrines.

Von Mises did however point out the issues with having a currency backed by gold dictated by the state, and how it in itself is not a major factor to go against it:

The main objection raised against the gold standard is that it makes operative in the determination of prices a factor that no government can control — the vicissitudes of gold production. Thus an “external” or “automatic” force restrains a national government’s power to make its subjects as prosperous as it would like to make them. The international capitalists dictate and the nation’s sovereignty becomes a sham.

However, the futility of interventionist policies has nothing at all to do with monetary matters. It will be shown later why all isolated measures of government interference with market phenomena must fail to attain the ends sought. If the interventionist government wants to remedy the shortcomings of its first interferences by going further and further, it finally converts its country’s economic system into socialism of the German pattern. Then it abolishes the domestic market altogether, and with it money and all monetary problems, even though it may retain some of the terms and labels of the market economy. In both cases it is not the gold standard that frustrates the good intentions of the benevolent authority.

Ron Paul gave an outstanding argument for the basis of gold as well:

Therefore Ted Cruz is right, the time for a return to the gold standard is now.