LISTEN TO TLR’S LATEST PODCAST:

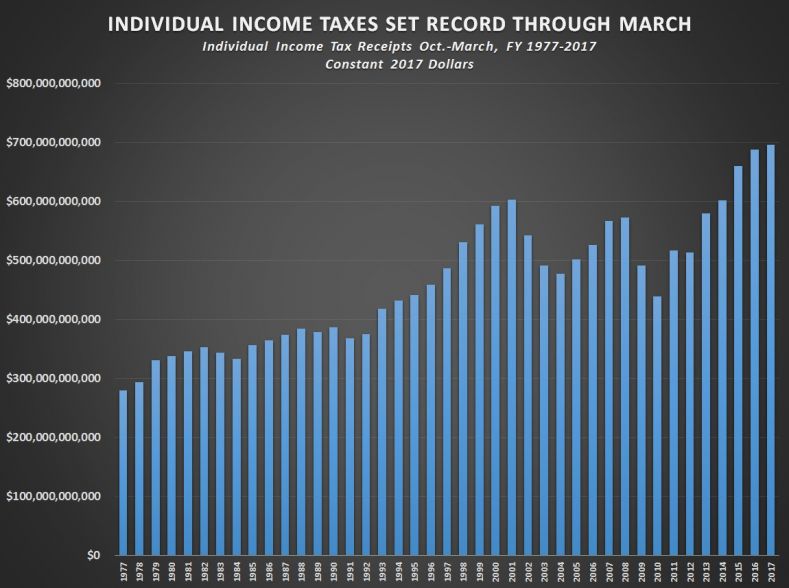

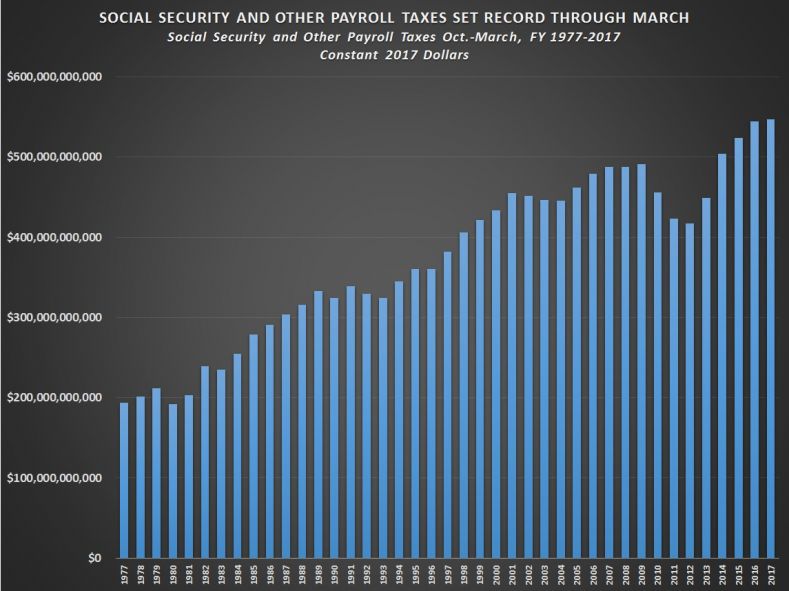

The federal government collected record amounts of both individual income taxes and payroll taxes through the first six months of fiscal 2017 (Oct. 1, 2016 through the end of March), according to the Monthly Treasury Statement, reports CNSNews.

The report explains that through March, the federal government collected approximately $695,391,000,000 in individual income taxes. That is about $7,387,280,000 more than the $688,003,720,000 in individual income taxes (in constant 2017 dollars) that the federal government collected in the first six months of fiscal 2016.

For Social Security, the federal government collected $547,491,000,000 and other payroll taxes during the first six months of fiscal 2017. That is about $2,731,820,000 more than the $544,491,000,000 in Social Security and other payroll taxes (in constant 2017 dollars) that the government collected in the first six months of fiscal 2016, explained the report.

And even though the treasury collected record amounts of income, it has managed to still run a deficit of $526,855,000,000 in the first six months of fiscal 2017, according to CNSNews.

CNSNews also mentioned that even though there were record revenues from individual income taxes and payroll taxes in the first six months of fiscal 2017, overall federal tax collections were slightly down.

In the first six months of fiscal 2016, the federal government collected $1,513,124,070,000 (in constant 2017 dollars) in total taxes. In the first six months of this fiscal year, total federal tax collections have dropped to $1,473,137,000,000—a decline of about $39,987,070,000 from total tax collections in the first six months of fiscal 2016.

The federal government ran its $526,855,000,000 deficit through the first six months of this fiscal year because while the Treasury was collecting $1,473,137,000,000 in total taxes, it was spending $1,999,991,000,000.

Because there were 153,000,000 people employed in the United States in March, according to the Bureau of Labor Statistics, the $1,473,137,000,000 in taxes the federal government has collected so far this fiscal year equals about $9,628 for every person with a job.

The $526,855,000,000 deficit equals about $3,443 for every person with job, explained CNSNews.

2 comments